BTC Price Prediction: Navigating the Correction - Is Now the Time to Invest?

#BTC

- Technical Downtrend: Price is trading below the 20-day moving average with a negative MACD, indicating bearish momentum in the near term.

- Negative Market Sentiment: News headlines reflect extreme fear, whale caution, and regulatory pressure, aligning with and amplifying the technical sell-off.

- Long-Term vs. Short-Term Dichotomy: While the short-term outlook is cautious due to the correction, underlying institutional interest and Bitcoin's core value proposition continue to offer potential for long-term investors.

BTC Price Prediction

Technical Analysis: Bitcoin at Critical Juncture Below Key Moving Averages

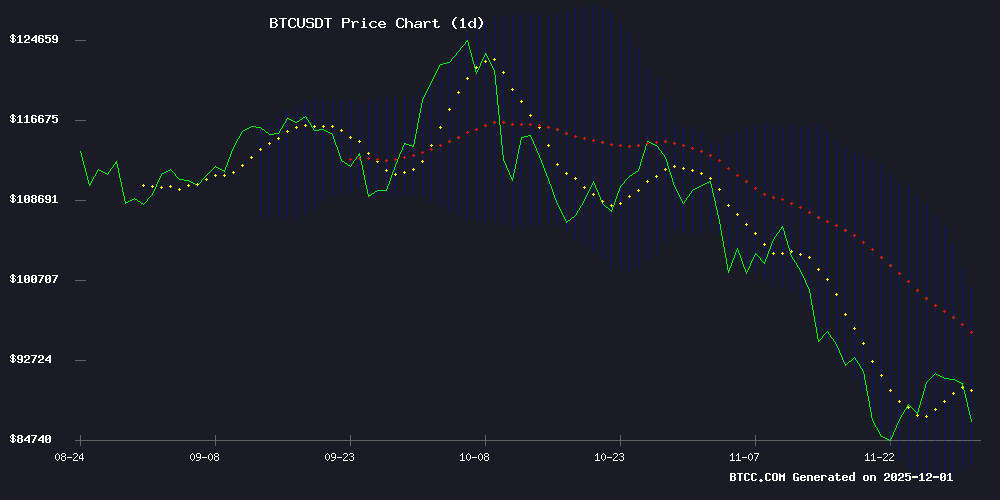

According to BTCC financial analyst James, Bitcoin's current price of $84,861.54 sits significantly below its 20-day moving average of $91,013.40, indicating a bearish short-term momentum. The MACD reading of -1,506.21 shows the momentum indicator is in negative territory, reinforcing the downward pressure. However, James notes that the price is hovering just above the lower Bollinger Band at $81,975.31, which could act as a potential support level. A sustained break below this band WOULD likely signal further downside, while a rebound toward the middle band at $91,013.40 would be the first sign of stabilization.

Market Sentiment: Extreme Fear and Whale Caution Dominate Headlines

BTCC financial analyst James points to a confluence of negative news driving market sentiment. Headlines highlight 'extreme fear,' whales retreating, and a sharp correction, which aligns with the technical picture of a downtrend. The seizure of $27M in Bitcoin by Europol and MicroStrategy's stock plunging 12% add to the negative backdrop. However, James cautions that such pervasive fear can sometimes precede a contrarian bounce, and the news of a national bank testing crypto exposure hints at underlying institutional interest that may provide a longer-term floor.

Factors Influencing BTC’s Price

Bitcoin Whales Shift Tactics as Market Enters Correction Phase

Bitcoin's slide below $90,000 has sparked debate about whether the cryptocurrency is entering a bearish cycle. On-chain data reveals a divergence between whale activity and retail inertia, with large holders aggressively repositioning while smaller investors remain sidelined.

Binance has seen a surge in whale-sized BTC inflows, according to CryptoQuant's Darkfost. Transfers exceeding 100 BTC suggest institutional players are adjusting exposure—a defensive MOVE that often precedes volatility. This comes as open interest contracts sharply from $47.5 billion to $29 billion, indicating widespread deleveraging.

The market's two-month consolidation follows Bitcoin's parabolic rally earlier this year. Whales appear to be building liquidity buffers, while retail traders show uncharacteristic restraint. Such divergence typically either foreshadows capitulation or sets the stage for the next leg up.

Bitcoin Whales Retreat Amid Market Rebound, Signaling Caution

Bitcoin's brief rally above $91,000 has been met with an unexpected development: whale accumulation has stalled. Wallet addresses holding 100-1,000 BTC—typically the market's most aggressive buyers—have abruptly stopped adding to positions. This withdrawal of institutional-scale demand creates structural uncertainty in what should be a bullish moment.

Analyst Joao Wedson notes the divergence between price action and whale behavior suggests either profit-taking or preparation for volatility. The pause comes after months of sustained accumulation, making its timing particularly notable. When whales retreat, retail traders often follow—a pattern that could test the durability of Bitcoin's current support levels.

MicroStrategy Shares Plunge 12% as Bitcoin Correction Deepens

MicroStrategy's stock (MSTR) tumbled 12% this week as its billion-dollar Bitcoin bet turned sour. The company's fortunes remain tightly coupled with BTC, which has now erased 33% of its value since early October's record high of $126,210. At $84,600, Bitcoin finds itself testing levels not seen since August's flash crash.

The contagion spreads across crypto equities: Coinbase dips 4%, Robinhood slides 5.2%, while miner Riot Platforms sinks 7%. Michael Saylor's once-celebrated BTC accumulation strategy now exemplifies the sector's whipsaw volatility. "When the tide goes out, you see who's swimming naked," observes one fund manager, requesting anonymity.

Market technicians note ominous parallels to August 2024's 18% weekly collapse. Risk-off sentiment dominates as capital flees to bonds and gold. The crypto complex braces for further turbulence, with leverage unwinds threatening cascading liquidations.

Tech and Crypto Stocks Lead Market Retreat as Bitcoin Slumps

U.S. equities dipped Monday with the S&P 500 and Nasdaq falling 0.2% as cryptocurrency-exposed names underperformed. Coinbase (COIN) shares tumbled 6% amid broad crypto market weakness, mirroring declines in Bitcoin and major altcoins. The selloff extended to Robinhood (HOOD), down 5%, as retail trading activity cooled.

Moderna (MRNA) dropped 6% after FDA officials proposed stricter vaccine approval standards. Sandisk (SNDK) reversed last week's gains with a 7% plunge despite its recent S&P 500 inclusion.

Transportation stocks bucked the trend, with Old Dominion (ODFL) and J.B. Hunt (JBHT) rising 6% and 4% respectively after BMO Capital praised their operational advantages. Wynn Resorts (WYNN) gained 4% on Goldman Sachs' endorsement of its Las Vegas operations.

Synopsys (SNPS) climbed 4% following Nvidia's $2 billion investment announcement, highlighting continued capital flows into semiconductor infrastructure.

Bitcoin Extends Decline as Crypto Market Remains in Extreme Fear

Bitcoin slipped below $86,000, extending a weeks-long retreat from October's highs NEAR $125,000. The Crypto Fear and Greed Index hovered near 20—a slight improvement from recent lows but still reflecting extreme market anxiety.

Derivatives data show persistent long liquidations and negative funding rates as traders prioritize liquidity over risk. Altcoins failed to rotate into strength, with only MYX Finance and JUST showing isolated activity against Bitcoin's dominant downtrend.

ETF outflows and macroeconomic uncertainty continue draining capital from crypto markets. The sector now faces its sternest test since the bull run began, with Bitcoin's performance dictating sentiment across all digital assets.

Strategy Builds $1.44B Reserve to Bolster Bitcoin Treasury Ambitions

Michael Saylor's Strategy has established a $1.44 billion USD reserve, expanding its balance sheet to reinforce its position as the world's dominant bitcoin treasury. The reserve, funded through at-the-market stock sales, will support preferred stock dividends and interest payments while providing liquidity buffers against crypto market volatility.

The firm now holds 650,000 BTC—approximately 3.1% of Bitcoin's total eventual supply—alongside its new dollar reserve. CEO Phong Le confirmed the USD reserve covers 21 months of dividend obligations, with plans to extend coverage to 24 months. 'This dual-reserve structure positions us to weather short-term turbulence while executing our vision,' said Executive Chairman Saylor.

The move comes as institutional holders increasingly adopt hybrid treasury strategies, pairing cryptocurrency exposure with traditional liquidity management. Strategy's reserve exceeds typical corporate cash cushions, reflecting the unique volatility profile of digital asset portfolios.

Strategy’s Bitcoin Liquidation Threshold Revealed Amid Stock Plunge

Strategy CEO Phong Le has delineated the conditions under which the firm may liquidate portions of its $55 billion Bitcoin treasury. The trigger point emerges when the company’s mNAV ratio—a key metric comparing market capitalization to net asset value—falls below 1. Currently at 1.19, this buffer leaves limited room for error as MSTR stock hemorrhages 40% year-to-date.

The revelation came during a candid podcast appearance where Le framed BTC sales as a last resort to service preferred share dividends. 'When yield becomes mathematically untenable below 1x mNAV, we’ll prioritize shareholder obligations over HODLing dogma,' he stated, referencing 2022’s crypto winter when the company proactively retired Bitcoin-backed debt.

With 649,870 BTC ($46 billion at current prices) constituting the largest corporate treasury, Strategy’s potential liquidation horizon now looms as a Sword of Damocles over crypto markets. The firm’s calculus suggests selling pressure could materialize abruptly should equity markets continue punishing the stock.

Bitcoin’s Bearish Turn Sparks Warnings of Deeper Correction

Bitcoin’s sudden plunge below $86,000 has triggered alarm among analysts, with Bloomberg Intelligence’s Mike McGlone predicting this 7% drop may be the precursor to a steeper decline. The cryptocurrency now faces a potential 35% correction, possibly retesting $50,000—a level last seen in early 2024.

Market dynamics point to a perfect storm: collapsing exchange volumes ($1.59 trillion in November), $3.48 billion in ETF outflows, and a resurgent gold market stealing safe-haven demand. Meanwhile, the specter of monetary tightening looms from Tokyo, where BOJ rate hike speculation is unwinding Leveraged positions across crypto markets.

‘This isn’t just a pullback—it’s the market remembering crypto’s volatility,’ McGlone observes, noting record-low stock volatility and an oversupply of altcoins exacerbate Bitcoin’s vulnerability. Polymarket traders now price a 52% chance of BOJ action in December, with Arthur Hayes of BitMEX fame warning USD/JPY movements could dictate crypto’s near-term fate.

Europol Shuts Down $1.4B Cryptomixer, Seizes $27M in Bitcoin and 12TB of Data

Europol, alongside German and Swiss authorities, has dismantled one of Europe's largest crypto-mixing services, confiscating €25 million ($27 million) in Bitcoin and over 12 terabytes of user data. The operation, codenamed 'Cryptomixer,' was active since 2016 and processed more than €1.3 billion in illicit funds, primarily linked to ransomware groups and darknet markets.

The takedown, executed between November 24 and 28 in Zurich, involved seizing servers, taking control of the cryptomixer(dot)io domain, and replacing it with a law enforcement notice. The hybrid service operated on both the clear and dark web, obscuring transactions for criminal enterprises.

This marks a significant milestone in the EU's crackdown on money laundering tools in the crypto space. The seized Bitcoin highlights regulators' growing focus on tracing and intercepting blockchain-based financial crime.

Czech National Bank Tests Crypto Portfolio with $1 Million Exposure

The Czech National Bank (CNB) has launched a pilot program allocating $1 million to a cryptocurrency portfolio comprising Bitcoin, stablecoins, and tokenized deposits. Governor Aleš Michl emphasized this is not a simulation but hands-on experimentation with technologies reshaping global finance.

The Bank Board approved the initiative on October 30 following an analysis of new asset classes. While only the crypto-related findings were disclosed, the CNB clarified it has no plans to add digital assets to its international reserves. The test operates independently from traditional reserve management.

Governor Michl conceived the project in January 2025 as a way to evaluate Bitcoin's utility for central banks. The scope later expanded to include USD-pegged stablecoins and tokenized deposits, reflecting their growing role in financial infrastructure.

Bitcoin Dips Below $87K as Market Volatility Spurs Interest in Layer 2 Solutions

Bitcoin's recent drop below $87,000 underscores the heightened volatility characteristic of late-cycle markets. Even blue-chip assets are not immune to sharp intraday swings, with 2-3% moves now capable of shaking leveraged positions and testing investor conviction—particularly among newer entrants.

Seasoned traders view this turbulence not as a rejection of Bitcoin's bullish thesis, but as a catalyst for portfolio repositioning. The focus is shifting from spot BTC accumulation to high-beta plays that capture upside potential while mitigating daily price fluctuations. Infrastructure narratives, particularly around Bitcoin's LAYER 2 ecosystems, are gaining traction as conduits for this strategy.

Projects like Bitcoin Hyper ($HYPER) exemplify the growing demand for scalable solutions that enable BTC utilization beyond store-of-value applications. Programmable sidechains and DeFi rails are emerging as critical infrastructure for the next growth phase—one defined by high-throughput, low-fee environments where Bitcoin's liquidity can be deployed productively.

Is BTC a good investment?

Based on the current technical and sentiment data provided, Bitcoin presents a high-risk, high-potential reward scenario that may not be suitable for all investors in the short term.

Current Technical Snapshot (2025-12-02):

| Metric | Value | Interpretation |

|---|---|---|

| Price | $84,861.54 | Below key average |

| 20-Day MA | $91,013.40 | Resistance level |

| MACD | -1,506.21 | Bearish momentum |

| Bollinger Lower Band | $81,975.31 | Near-term support |

As BTCC financial analyst James observes, the price is in a clear corrective phase below its moving average with negative momentum. The market news cycle is dominated by fear, whale selling, and regulatory actions, which typically pressure prices further.

Whether BTC is a 'good' investment depends entirely on your profile:

- For short-term traders: The trend is currently down. The risk of a deeper correction toward the $82K support is present. This environment requires caution.

- For long-term investors: Corrections are normal in volatile asset classes. The news of institutions like the Czech National Bank testing exposure and companies building reserves suggests foundational demand remains. A strategy of dollar-cost averaging during fear phases has historically been rewarding.

In summary, while the immediate technicals and sentiment are bearish, the long-term adoption thesis appears intact. It could be a good investment for those with a high risk tolerance and a multi-year horizon, but likely a risky proposition for those seeking quick gains.